As we are now nicely into 2024, it’s certain the SE16 housing market over the last 18 months has been a little more restrained than 2020, 2021 and early 2022, and I believe that the ‘steady as she goes’ outlook will continue into the rest of 2024 and beyond.

As property ownership is a medium to long-term investment, it is important to see what has happened to SE16 house prices.

Since the start of the Millennium (Jan 2001), the average SE16 homeowner has seen their property’s value rise by an average of 238%.

This is important as house prices are a national obsession and tied into the health of the UK economy as a whole. Most of that gain has come from the overall growth in SE16 property values, while some of it will have been enhanced by extending, modernising or developing their SE16 home.

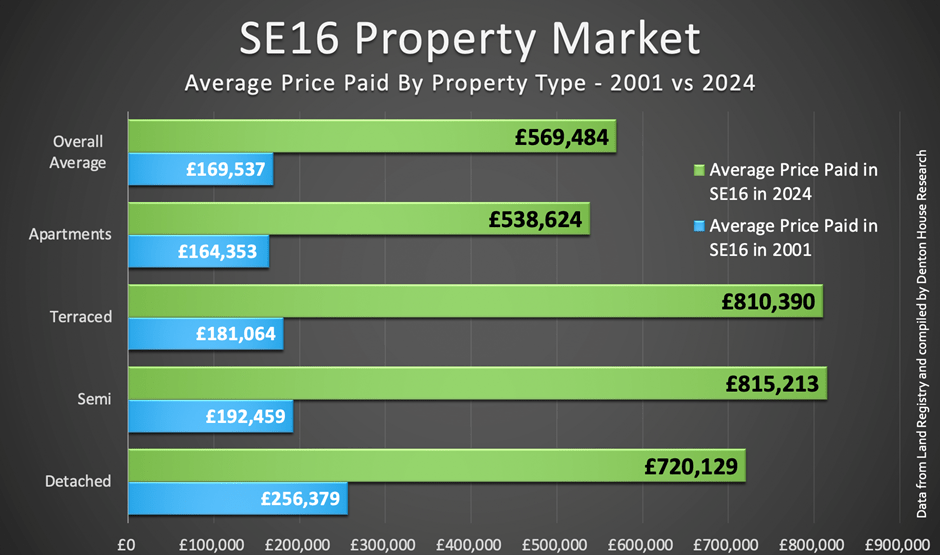

Taking a look at the different types of property in SE16 and the profit made by each type, it makes interesting reading:

- Overall Average For All Homes in SE16. The average price of all homes in SE16 in 2001 was £169,537. Now it’s 2024, it has risen to £569,484. This is a total profit of £399,947 (which is £17,389 profit per year per home or an annual growth of 10.3% per year).

- Apartments in SE16. The average price of an apartment in SE16 in 2001 was £164,353. Now it’s 2024, it has risen to £538,624. This is a total profit of £374,271 (which is £16,273 profit per year per home or an annual growth of 10.0% per year).

- Terraced/Town Houses in SE16. The average price of a terraced/town house in SE16 in 2001 was £181,064. Now it’s 2024, it has risen to £810,390. This is a total profit of £629,326 (which is £27,362 profit per year per home or an annual growth of 15.1% per year).

- Semi-Detached Homes in SE16. The average price of a semi-detached home in SE16 in 2001 was £192,459. Now it’s 2024, it has risen to £815,213. This is a total profit of £622,754 (which is £27,076 profit per year per home or an annual growth of 14.1% per year).

- Detached Homes in SE16. The average price of a detached home in SE16 in 2001 was £256,379. Now it’s 2024, it has risen to £720,129. This is a total profit of £463,750 (which is £20,163 profit per year per home or an annual growth of 7.9% per year).

However, we can’t forget there has been 79% inflation over those 23 years, which eats into the ‘real’ value (or true spending power of that profit) … so if we take into account inflation since 2001, the true ‘spending power’ of that profit has been lower.

- Overall Average For All Homes in SE16. The total ‘real profit’ (i.e., after inflation has been removed) for the average SE16 home is £222,564 for the last 23 years. This equates to £9,677 ‘real’ profit per annum.

- SE16 Apartments. The total ‘real profit’ (i.e., after inflation has been removed) for the average SE16 apartment is £208,275 for the last 23 years. This equates to £9,055 ‘real’ profit per annum.

- SE16 Terraced/Town Houses. The total ‘real profit’ (i.e., after inflation has been removed) for the average SE16 terraced/town house is £350,209 for the last 23 years. This equates to £15,226 ‘real’ profit per annum.

- SE16 Semi-Detached Homes. The total ‘real profit’ (i.e., after inflation has been removed) for the average SE16 semi-detached home is £346,552 for the last 23 years. This equates to £15,067 ‘real’ profit per annum.

- SE16 Detached Homes. The total ‘real profit’ (i.e., after inflation has been removed) for the average SE16 detached home is £258,069 for the last 23 years. This equates to £11,220 ‘real’ profit per annum.

Thus, the annual profit for an average SE16 home, adjusted for inflation, stands at £9,677.

I wanted to illustrate that despite the 2008/09 Credit Crunch property market crash, which saw SE16 property values plummet by 15% to 20% over 18 months, homeowners in SE16 have still fared better over the long term than those renting.

Looking ahead, a common question I get asked is about the future trajectory of the SE16 property market.

The primary influence on maintaining house price growth in SE16 over the medium to long term will be the construction of new homes locally and nationally. Although we have yet to get the figures for 2023, government sources indicate that the number of new households is expected to be between 210,000 and 220,000. Considering the annual need is for 300,000 new households to meet demands arising from factors such as immigration, increased life expectancy, higher divorce rates, and later cohabitation, it’s clear that demand will continue to outstrip supply unless the government heavily invests in building council houses.

This can only be good news for SE16 homeowners.

What about SE16 landlords, though?

Even though the number of landlords liquidating their property portfolios has increased in the last couple of years and the number of landlords buying is lower than in the 2000s and 2010s, there is still net growth in the size of the private rented sector each year. This is all despite facing higher taxes. The simple fact is many SE16 landlords remain keen on expanding their portfolios in the long term.

The younger generation in SE16 views renting as a choice that offers flexibility and alternatives that homeownership does not provide. This means that demand for rentals will keep growing, allowing landlords to enjoy rising rents and capital appreciation. However, SE16 buy-to-let landlords must adopt more thoughtful strategies to maintain profitable returns from their investments.

As a SE16 buy-to-let landlord, the question for you is how to ensure this growth continues.

Since the 1990s, generating profits from buy-to-let property investments was straightforward. Moving forward, with changes in the tax laws and the balance of power, achieving similar returns will be more effortful. Over the past decade, I’ve observed the evolution of agents from mere rent collectors to strategic portfolio managers. I, along with a select few agents in SE16, am adept at providing comprehensive, strategic portfolio leadership. This service offers a structured overview of your investment goals across short, medium and long-term horizons, focusing on your expected returns, yields and capital growth. If you seek such advice, feel free to contact your current agent or me directly at no cost or obligation.