As an SE16 landlord, it’s important to understand what happens to a tenant’s deposit when you decide to sell your rental property while the tenant is still living in it. If the property is sold with the tenant in situ, the new landlord will need to consider how to deal with the tenancy deposit. Both… Continue reading Bought an SE16 buy-to-let property with a sitting tenant recently?

SE16 Property Market

Is now a good time to buy, or should people wait? As we go into the second quarter of 2023, there is significant uncertainty in the UK economy, leading to uncertainty in the property market. The number one issue is the fight against inflation and the cost-of-living crisis. The Bank of England is working hard… Continue reading SE16 Property Market

Buying a Home in SE16 is Still £2,791 a Year Cheaper Than Renting

With mortgage rates tripling over the last 12 months, one could be forgiven for thinking buying a home in SE16 as a first-time buyer would out of the question. Yet, what if I told you, it is £2,791 a year cheaper to buy a home in SE16 as a first-time buyer than renting, would you… Continue reading Buying a Home in SE16 is Still £2,791 a Year Cheaper Than Renting

New tax rules for SE16 buy-to-let landlords from 2026

We at Metro Village want to make you aware of some important changes that are coming into effect from April 2026. The UK Government is introducing Making Tax Digital (MTD) for Income Tax, which will affect how landlords report their income tax to HMRC. The original plan was for Landlords income of £10,000 or more… Continue reading New tax rules for SE16 buy-to-let landlords from 2026

Unveiling the Secrets of SE16’s Housing Market: Insights from the 2021 Census

The property market is one of the most important economic indicators, as it can significantly impact the prosperity of both the local and national economy. Recently, new data from the Census 2021 has become available that sheds light on seldom discussed areas of property, such as the types of properties SE16 has, together with how… Continue reading Unveiling the Secrets of SE16’s Housing Market: Insights from the 2021 Census

Is it Now or Never for the SE16 Property Market?

Traditionally, the first four months of the year are usually an estate agents’ busiest time for house sales. However, if the last three years have taught us anything, nothing is ‘normal’ and ‘usual’ anymore. The SE16 property market is finding that with the friction of higher mortgage rates and the effects of inflation on household… Continue reading Is it Now or Never for the SE16 Property Market?

Cautious Optimism in the SE16 Property Market

As the British and SE16 property market navigates the ongoing economic turmoil, many SE16 homeowners and landlords may feel uncertain about the future. However, up-to-date data suggests that the 2023 property crash predicted by the many newspapers and the usual clickbait doom-mongers in the lead-up to Christmas on social media, may not be as bad… Continue reading Cautious Optimism in the SE16 Property Market

Is your SE16 home bigger than 764 sq ft?

SE16 Homeowners – Do you know how big your SE16 home is? What is the square footage of your SE16 home? Don’t worry, most of us don’t – yet it could be fundamental as SE16 home buyers search for new homes. Us Brits are obsessed with our homes, yet most SE16 homeowners need to learn… Continue reading Is your SE16 home bigger than 764 sq ft?

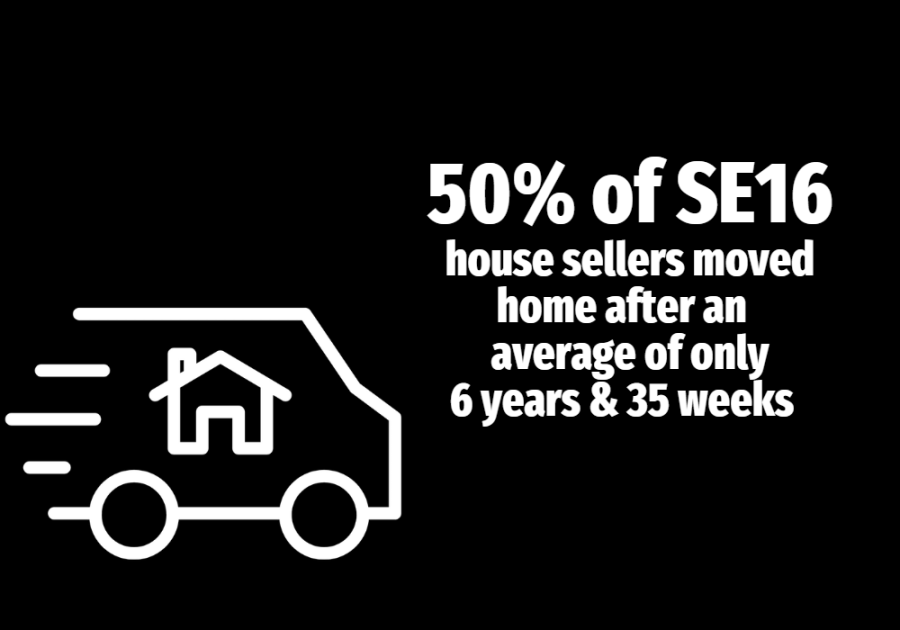

50% of SE16 house sellers in 2022 had only been in their old home on average 6 years and 35 weeks

The share of Brits moving each year has been declining since the late 1980s (when at one stage, people moved every eight years), yet since the pandemic’s beginning, something has appeared to upset that trend. Newspaper stories and social media posts painted a picture of homeowners moving from the city centres to its suburbs, from the… Continue reading 50% of SE16 house sellers in 2022 had only been in their old home on average 6 years and 35 weeks

Is Buy-to-Let in SE16 Still Worth the Risk?

Over the last five years, life has become a little trickier for SE16 landlords, with changes to their taxation status, mortgage interest relief and an additional 3% stamp duty for a buy-to-let property, and has made lots of SE16 landlords ask themselves: ‘Is buy-to-let in SE16 still worth the risk?’ Regarding taxation, in 2016, the Government… Continue reading Is Buy-to-Let in SE16 Still Worth the Risk?